Skd884

MB Enthusiast

- Joined

- Sep 13, 2017

- Messages

- 3,529

- Car

- c180 w204

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Not sold any = not lost a penny.It'll be fun to review your portfolio in six months again.

You've lost 57% on Avacta since April 2021, but let's see what happens over the next six months.

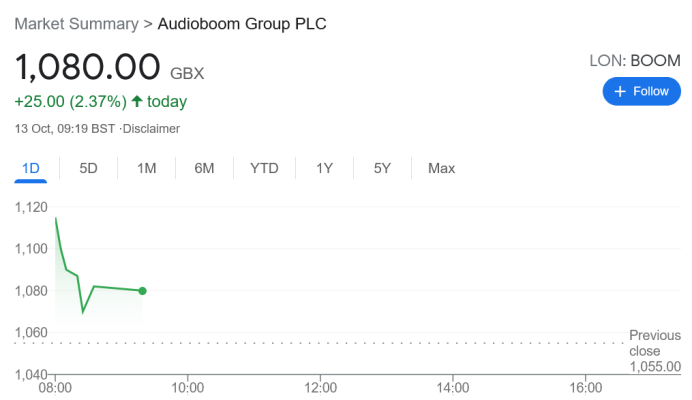

Shall we discuss Boom which i purchased at circa £1.70 ?Well said: 18th April, Avacta was 248p. Today it's 106p.

Anyone buying on 18th April would have lost 57% of their money as of today.

It's been a tough six months, but a general investment fund would have returned 5-6% over just that 6 month period. Over 10 years a realistic 10% compound interest will generate an extra 160%, tax-free if through an ISA.

Err. Isn’t it equallyNot sold any = not lost a penny.

Thanks

On financial advice when i had my children and was going to set something up in there name, i was told don't put it in there name, because you never know what the future holds and you could be giving a drug addict a nice amount of money they could kill themselves with. That never even entered my head, so i thought i would pass it on.

son has be attending GA for the last three years, and thankfully has now sorted himself out

On financial advice when i had my children and was going to set something up in there name, i was told don't put it in there name, because you never know what the future holds and you could be giving a drug addict a nice amount of money they could kill themselves with. That never even entered my head, so i thought i would pass it on.

Be alert that it might not be that straight forward and everyone, including the son, could be at risk of being a little naive that it has been sorted out. Just like drinking, a prudent view is 'I will always be an addict', or at least at increased risk of relapse given certain triggers. E.g. a load of cash dropping,

ker-ching

One of my ex-girlfriend's dad was an alcoholic, and had a massive heath scare that stopped him drinking (but killed him a couple of years later nonetheless). But he filled the void with gambling. Went to GA (or went somewhere), told everyone it was sorted, but in reality he just got more covert with it and was also the power of attorney for his elderly mum's finances. After he died and his wife got access to all his financial dealings, his mum's savings had also been entirely rinsed and everyone thought he was on top of it. Thankfully the £70k unsecured personal debt on credit cards died with him (that no one knew about).

I only mention this as a cautionary tale and urge extra vigilance as the money is released.

My thoughts are:

- Given that he already holds 315k shares worth £3.3m, it makes me wonder why he would buy another 1904 shares, adding 0.6% to his existing holding?

I don't understand the logic behind your frequent posts about shares that you hold.

We use essential cookies to make this site work, and optional cookies to enhance your experience.