pioneercollector

MB Enthusiast

Hi All,

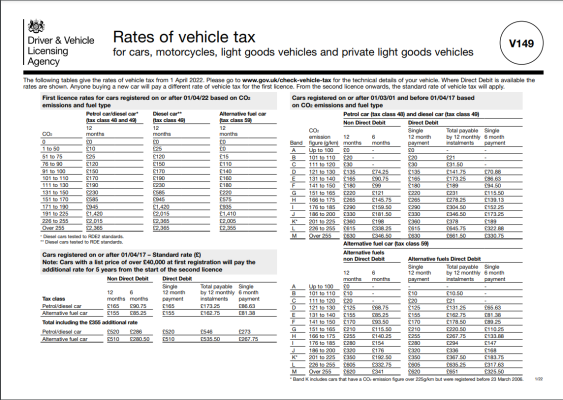

As i am sure you are all aware that the cars registered after 2006 and produce over 252 CO2 / KG whatsits are charged around £600 per year..... Well I purposely chose a 2003 SL500 because the road tax was £335 - Well guess what? The marvelous money making bandits have decided that the parameters now start in 2001 !! And the road tax is going to be around £630 per year....

I am sure that this is just another lame tactic to force the use of Electric Vehicles upon everyone, and as soon as a certain percentage of us own one then we will all be liable for EV road tax....

Grrrr moan over

Not overly happy - But am looking forward to taking the SL to Brooklands this weekend for a four day break

As i am sure you are all aware that the cars registered after 2006 and produce over 252 CO2 / KG whatsits are charged around £600 per year..... Well I purposely chose a 2003 SL500 because the road tax was £335 - Well guess what? The marvelous money making bandits have decided that the parameters now start in 2001 !! And the road tax is going to be around £630 per year....

I am sure that this is just another lame tactic to force the use of Electric Vehicles upon everyone, and as soon as a certain percentage of us own one then we will all be liable for EV road tax....

Grrrr moan over

Not overly happy - But am looking forward to taking the SL to Brooklands this weekend for a four day break