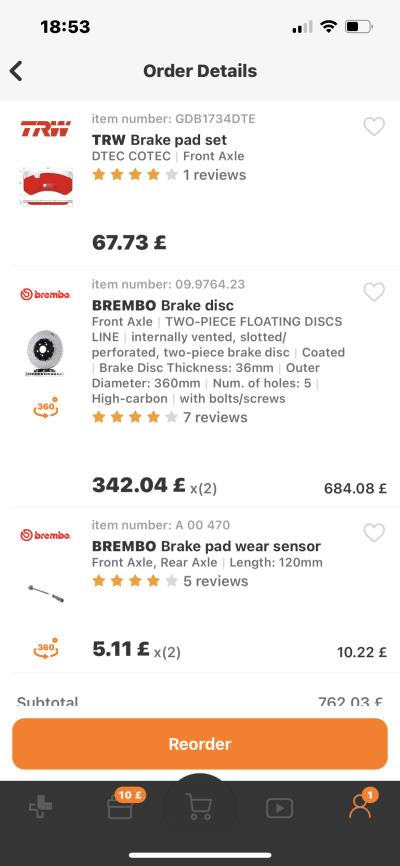

My AUTODOC invoice for less that £200 a few months ago. Nothing else to pay.

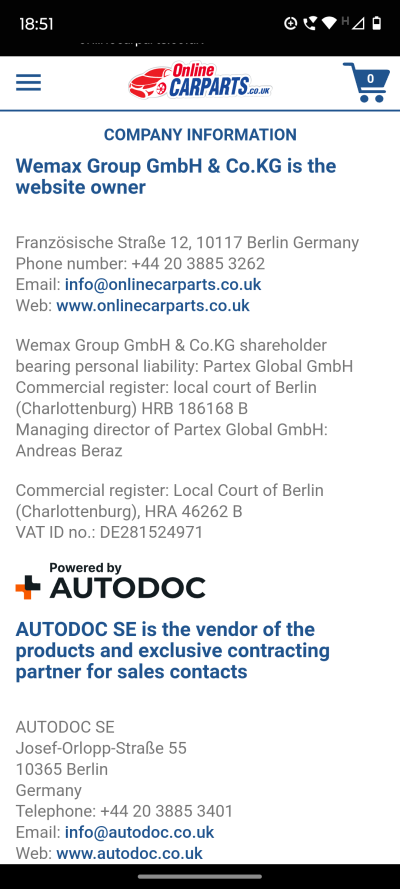

All that matters from a VAT & duty POV is where the goods shipped to you from. In this case you were charged UK VAT on the order (even though it was over the £135 threshold), so it was presumably dispatched from a UK warehouse. The sports store Decathlon (which is French) definitely does this - moving stock from a European warehouse to fulfil online orders from their '.co.uk' website. If they sent directly from the warehouse you'd be liable for VAT and duty on arrival (if the order was £135+), even though you'd purchased from a "uk" website.