- Joined

- Mar 11, 2013

- Messages

- 11,236

- Location

- South Bucks

- Car

- CLS63 SB, ML63, CLK350 'Vert, E350 CGI 'Vert, Triumph Sprint (Bike not Dolly...),

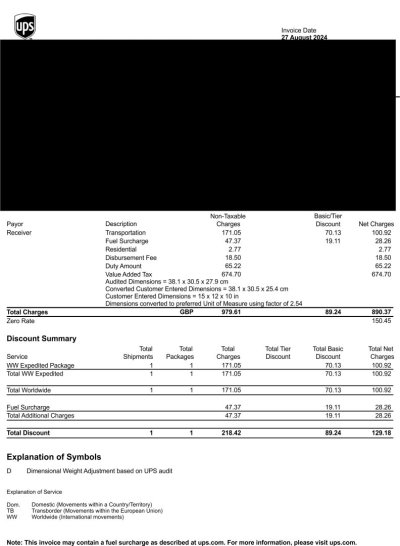

Nothing to do with HMRC; it's not import duty or VAT. In the unlikely event that a mistake has been made in Customs clearance, that can be corrected, but I'm pretty sure that's not the case. Legal proceedings would go nowhere; I have no contract with UPS, but the amount is so small that it would not be worth it.

I'd just like to know what the legal basis is for this charge being levied on the recipient. Royal Mail don't try to charge me for carrying parcels to my door and ringing the doorbell.....

I'd just like to know what the legal basis is for this charge being levied on the recipient. Royal Mail don't try to charge me for carrying parcels to my door and ringing the doorbell.....