Martinjs

Active Member

- Joined

- Jun 9, 2012

- Messages

- 101

- Car

- 2021 C300 AMG Line Night Edition Prem +

I retired recently so I called MB insurance today to advise that I am no longer employed and I don’t need cover for commuting anymore.

Cost me £38+ in order to comply with their requirements to inform them of any changes, £18 premium increase!, and £20 administration fee.

Just done the same for our smart roadster which insured with Aviva, did it online, took a couple of minutes cost = zero.

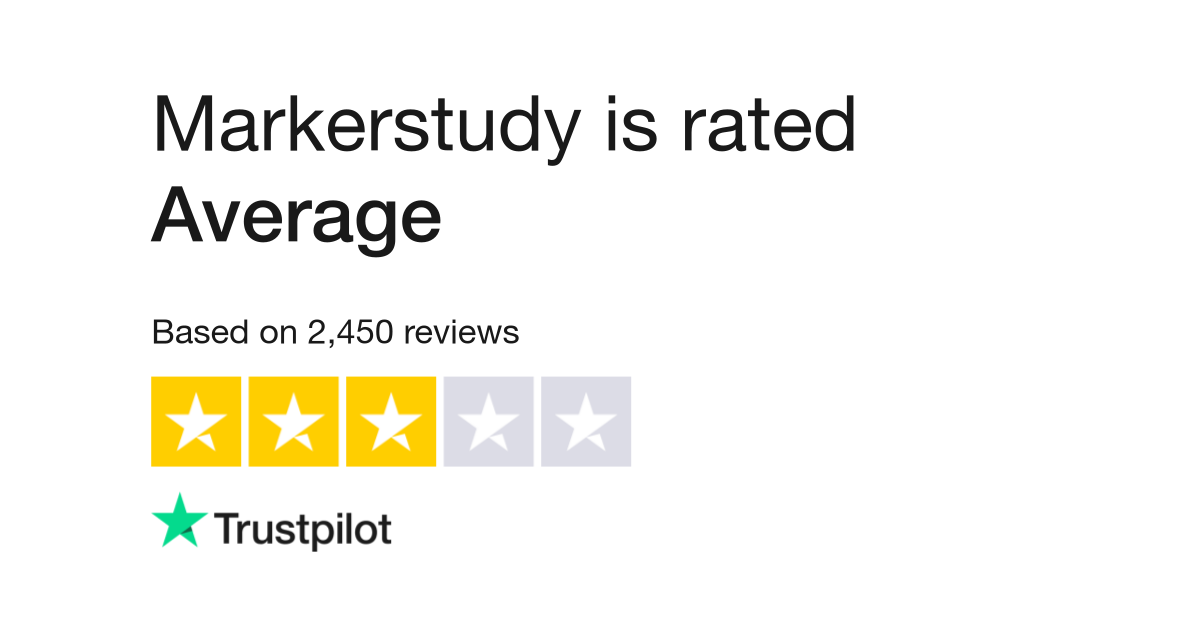

The MB service is contracted out to a set-up called Markerstudy Insurance Services - takes them 15 mins to answer a call - seem understaffed.

I will be looking elsewhere at renewal - the service doesn’t live up to the MB image.

Cost me £38+ in order to comply with their requirements to inform them of any changes, £18 premium increase!, and £20 administration fee.

Just done the same for our smart roadster which insured with Aviva, did it online, took a couple of minutes cost = zero.

The MB service is contracted out to a set-up called Markerstudy Insurance Services - takes them 15 mins to answer a call - seem understaffed.

I will be looking elsewhere at renewal - the service doesn’t live up to the MB image.