Good video from Doug:

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

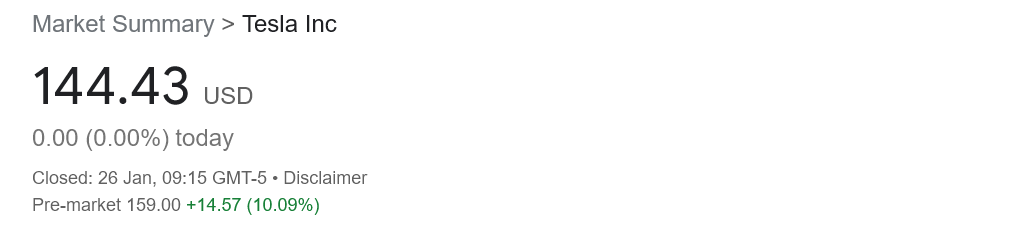

Tesla Market Capitalisation grows by $140bn in One Day

- Thread starter st13phil

- Start date

Skd884

MB Enthusiast

- Joined

- Sep 13, 2017

- Messages

- 4,170

- Car

- i3

It sure was ( i took loads ) $TSLA is up 58% in c3 weeksSo a good time to buy Tesla shares?

Tesla surpasses earning expectations even as Musk remains mired in lawsuits

The electric car company posted $24.3bn in fourth-quarter earnings, surpassing anticipated revenue

Last edited:

MikeInWimbledon

Hardcore MB Enthusiast

- Joined

- Nov 8, 2014

- Messages

- 13,575

- Car

- (Ex S211 E500, W212 E500, C216, S212 E500, W211 E500 5.5, W221 S500, S211 E500, SL500, S500, E55)

You remember how "everyone" criticises hedge funds for making too much money from shorting shares which they "know" are overvalued ?

It was a good week for Tesla share holder last week, thanks to the election and the likely trade tariffs against Chinese cars

Basically a 50% jump on the election result, making Tesla a trillion dollar market valuation.

The bad news: The technicians reckon that the hedge funds are sitting on a loss of $5 trillion. Yes, $5 trillion.

It was a good week for Tesla share holder last week, thanks to the election and the likely trade tariffs against Chinese cars

Basically a 50% jump on the election result, making Tesla a trillion dollar market valuation.

The bad news: The technicians reckon that the hedge funds are sitting on a loss of $5 trillion. Yes, $5 trillion.

Skd884

MB Enthusiast

- Joined

- Sep 13, 2017

- Messages

- 4,170

- Car

- i3

It sure was ( i took loads ) $TSLA is up 58% in c3 weeks

Tesla surpasses earning expectations even as Musk remains mired in lawsuits

The electric car company posted $24.3bn in fourth-quarter earnings, surpassing anticipated revenuewww.theguardian.com

View attachment 136292

MSG2004

MB Enthusiast

- Joined

- Feb 5, 2005

- Messages

- 1,560

- Location

- City

- Car

- GLE Amg-Line C Class Avantgarde C class Classic Auto Mondeo Ghia V6 Audi 2.3 Ford Sierra V6

Stock markets and the majority of share during the last 25 years and more so last 15 years or so are now just posh, big-money gambling dens, and betting shops. Gone are the days when fundaments counted and brand loyalty etc. Share are often talked up and down and as in life, the small investor is often bashed hard

I stopped trading shares in 2015 and thankfully came our slightly ahead. Yes, our pensions etc, etc ,etc depend on it but some people I know personally inc a relative blindly invested in Tesco as they saw this as a "very solid company," that is until a fundamental flaw was found out in their accounting practices. Thankfully he did not bail out and topped up as they went lower and came our on top but the sleepiness nights etc as hed put in close to 50k initially was not worth the risk again

I stopped trading shares in 2015 and thankfully came our slightly ahead. Yes, our pensions etc, etc ,etc depend on it but some people I know personally inc a relative blindly invested in Tesco as they saw this as a "very solid company," that is until a fundamental flaw was found out in their accounting practices. Thankfully he did not bail out and topped up as they went lower and came our on top but the sleepiness nights etc as hed put in close to 50k initially was not worth the risk again

MikeInWimbledon

Hardcore MB Enthusiast

- Joined

- Nov 8, 2014

- Messages

- 13,575

- Car

- (Ex S211 E500, W212 E500, C216, S212 E500, W211 E500 5.5, W221 S500, S211 E500, SL500, S500, E55)

Betting on one company or sector is a fool's game.

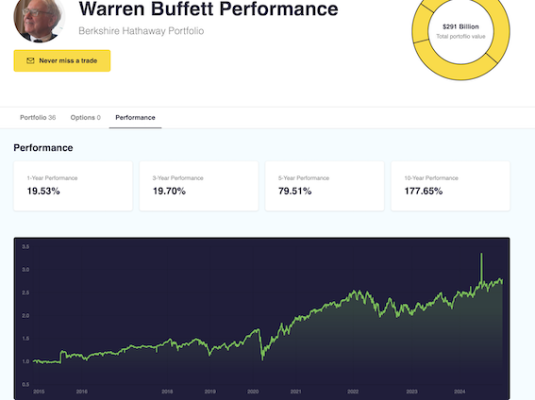

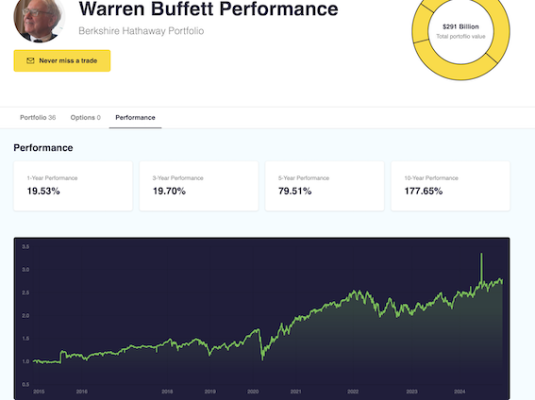

Dear old Warren, is happy with his 177% gain over the last decade. Nothing that clever, really, just a solid mix. (OK, ignore Apple for the minute)

And obviously, Warren has never, ever put money into Tesla.

(Let's hope those Old Boys who've shorted Tesla this last week weren't doing it with our Insurance or bank's money, or won't collapse "in an embarassing way")

Dear old Warren, is happy with his 177% gain over the last decade. Nothing that clever, really, just a solid mix. (OK, ignore Apple for the minute)

And obviously, Warren has never, ever put money into Tesla.

(Let's hope those Old Boys who've shorted Tesla this last week weren't doing it with our Insurance or bank's money, or won't collapse "in an embarassing way")

W1ghty

MB Enthusiast

Wasn’t he 50% invested into Apple until recently? …I know you said ignore that bitBetting on one company or sector is a fool's game.

Dear old Warren, is happy with his 177% gain over the last decade. Nothing that clever, really, just a solid mix. (OK, ignore Apple for the minute)

And obviously, Warren has never, ever put money into Tesla.

(Let's hope those Old Boys who've shorted Tesla this last week weren't doing it with our Insurance or bank's money, or won't collapse "in an embarassing way")

View attachment 163936

- Joined

- Jun 24, 2008

- Messages

- 49,608

- Location

- London

- Car

- 2022 Hyundai IONIQ 5 RWD / 2016 Suzuki Vitara AWD

Betting on one company or sector is a fool's game.

Dear old Warren, is happy with his 177% gain over the last decade. Nothing that clever, really, just a solid mix. (OK, ignore Apple for the minute)

And obviously, Warren has never, ever put money into Tesla.

(Let's hope those Old Boys who've shorted Tesla this last week weren't doing it with our Insurance or bank's money, or won't collapse "in an embarassing way")

View attachment 163936

I think he said that he never buys a business that he doesn't understand. He didn't actually advise others not to buy Tesla stock.

MikeInWimbledon

Hardcore MB Enthusiast

- Joined

- Nov 8, 2014

- Messages

- 13,575

- Car

- (Ex S211 E500, W212 E500, C216, S212 E500, W211 E500 5.5, W221 S500, S211 E500, SL500, S500, E55)

Warren doesn't advise others to buy or not to buy shares. (Even when he owns those shares)I think he said that he never buys a business that he doesn't understand. He didn't actually advise others not to buy Tesla stock.

Traditionally Warren looks for low price-to-book ratios and betas, high dividend-payout ratios and high rates of profit growth

He hasn't, and won't be able to find that in Tesla - at any point.

Tesla's profits have grown over the last year, but that wasn't predictable.

Price to Book? Horrific. It's speculative and based on Government largesse.

Dividend payout: well, it would help if Tesla started to pay dividends - Tesla has never paid a dividend.

Tesla satisfies just one of the requisite criteria for these “cheap, safe, quality stocks”: Its profits have grown impressively over the past five years. It fails the other criteria: Its price-to-book ratio is one of the highest in the market — higher than 88% of the other stocks in the S&P 1500

Warren's got a third of a trillion dollars in cash at the moment. It would be an insane move to throw any of it at Tesla. Even if Tesla does fly up on the back of the Trump-Elon partnership.

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)

Similar threads

- Replies

- 101

- Views

- 16K