Expensive luxury new cars typically lose a large amount of value in the first 3 years - 50% off doesn’t surprise me comparing RRP/list price to trade in value.

They’ve benefited from having the car new, in the spec they wanted, with full warranty for the first 3 years, no MOTs, brand new tyres/brakes etc and very little to do service wise

Only exceptional cars don’t lose much money, or unless you buy used, or when the market is behaving unusually (eg supply/demand after COVID)

You pay your money and take your choice.

I think I’d look out for competitive lease offers if you’re after an expensive EV - I would think the depreciation could be quite steep especially as new tech/models come out quite quickly. Buying a £100k EV is going to be expensive though however you manage it.

Exactly. Everything you said is correct. The guy said I won't pay for a single service during the 4 years I have it. I did the maths and it seems to be:

Value: £95k

-£25k tax break

I'm unsure if the company gets tax relief on the payments for it over the year. If so that's an extra £3-4k a year as an expense. On top of that, I'm left with a guaranteed residual of £44k in the car.

I'm on £950 a month, £1k deposit for 48 months. £45,600 payable during that period.

If I get a Porsche Taycan (for a similar price & spec), I have to pay interest and they want the residua value in the Porsche left (the balance( to be £33k). so I'll end up paying £82k over the same period for a similar value car. The insurance is also £1k higher and its ex-demo, which I assume means a little more wiggle room for them to tell me to go away if I complain about something.

£95-25-44 =£26.00k left which is being paid over 4 years. It's about £6.5k. a year.

Petrol large saloons used to lose 50% A little less now

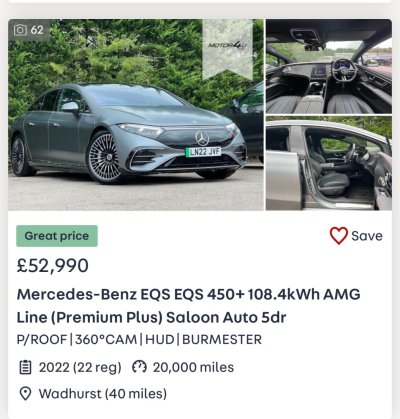

A large luxury EV will lose far more. I’d suggest at least 65%. Check out the used prices on Autotrader.. it’s all about the tax breaks for the first owner and the limited enthusiasm for very big luxury saloons

In two years: more than a 50% drop from £110k to £50k

View attachment 164299

The depreciation isn't too worrying on business PCP. In 4 years, they expect the car to be worth £44k. The most I'll pay is £50k during that time. Not ideal but it is what it is. I expect it'll probably hover slightly above £44k if I look after it so they might buy it back and allow me to swap to a new one for a good price. I know my sister did this with her recent car and ended up getting £10k.

MB know this. As do the other car makers. Which is how they set their pricing.

Yup. Delving into this has made me realise that a large proportion of high-end expensive EVs for normal people who aren't millionaires have to be via businesses. It makes sense as it allows for quicker adoption whilst keeping the economy moving.

If the scheme didn't exist, the depreciation would be a gigantic huge Bitter pill to swallow. I'd not buy an EV personally if it didn't exist.

___

I still do wonder if there is more wiggle room in the price. I spoke tentatively to other manufacturers and they seem to have room for negotiation but none of them can match the 0% APR 0% interest 0% deposit. Their first question is 'how much cash are you putting down'. With Mercedes, they don't care for EVs.

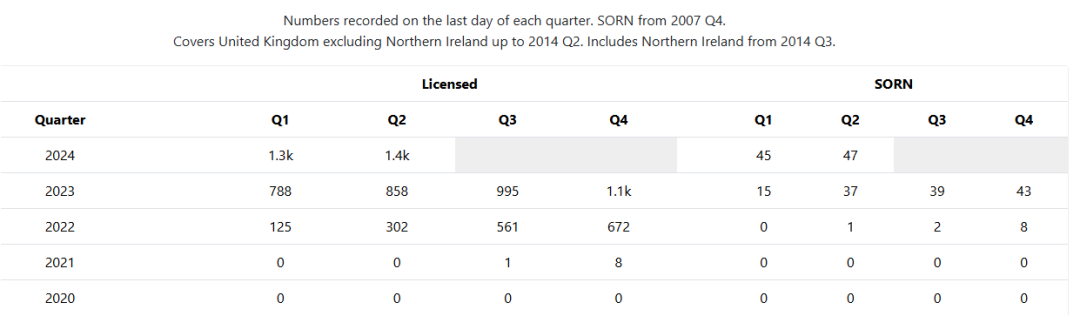

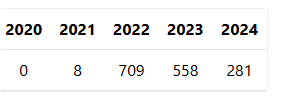

FWIW in the UK it looks like they've only shifted about 1400 EQS in total over the last 3 years (47 of which are SORNed?!):

View attachment 164300

Didn't they announce that they were dropping the platform it's built on?

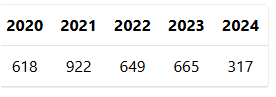

What's the number of S class for comparison?

As far as I'm aware, the EQS and EQ line will probably hang around for another 3-5 years until they fuse the S-class with the EQ line. It definitely feels like a failed experiment but the offer of 0% APR, 0% interest for an ultra luxurious car is crazy.

The BMW equivalent model is £115K RRP and that's without interest. With interest total repayments will be closer to 1.3-1.5k a month WITH a deposit.

The Mercedes equivalent is £950 with no deposit and a trade-in option at 4 years - which is probably just in time for when they'll dump the EQ line and can hop to the new electric line.

If I'm following along the wrong tracks please let me know. I'm open to looking elsewhere for better options if someone suggests one. The Porsche seems too expensive and it's depreciation is nearly just as rocky, the BMW TBH is not for me - lacks class/cosiness/comofrt and seems to be hard around the edges - has tech for the sake of tech.

If the Taycan team could offer me a similar package, I'd go for a green Taycan probably but then insurance is £1.5-2k more per year.

My other option is Audi, which is probably a good one but something tells me in the in-car experience of the Mercedes will be better, and I'm not convinced the Audi will hold its value either. Also I'm then subject to interest again.