The Hertz saga rolls on and is bad news for Polestar.

"

Hertz pauses plans to buy electric vehicles from Polestar this year

Decision by car rental group comes as resale value of EVs has collapsed

Peter Campbell in London FEBRUARY 5 2024

Hertz has paused plans to buy tens of thousands of battery-driven cars from Polestar this year, the head of the electric vehicle brand said, after a collapse in resale values last year caused the rental giant to taper its electric ambitions.

In 2022, Hertz agreed to buy 65,000 Polestar cars over five years in a deal likely worth $3bn as part of its ambition for EVs to make up a quarter of its rental fleet by the end of 2024. It also struck a deal to buy 100,000 Tesla cars.

But late last year, following a collapse in the resale value of EVs and citing higher repair costs than expected, Hertz said it would sell some of the Tesla cars it purchased and that it would not meet the 25 per cent EV target. It did not comment on the state of its relationship with Polestar at the time.

Polestar’s chief executive Thomas Ingenlath told the Financial Times that he had been contacted by Hertz’s chief executive Stephen Scherr last autumn to ask whether he could pause their agreement to buy a certain number of EVs throughout 2024. Between 2022 and 2023, Polestar sold about 13,000 battery-run cars to the group.

Some car rental groups operate a “buyback” model, where the manufacturer agrees to repurchase the vehicle at a set price. Hertz, however, largely operates an “at risk” model where it owns the vehicles outright, exposing it if the vehicles it holds depreciate significantly.

Polestar agreed to waive Hertz’s requirement to buy its allocated number of cars this year, in return for the rental group agreeing not to sell its current Polestar vehicles early or too cheaply, Ingenlath said.

The two companies agreed that Hertz “keep the cars longer than a year, we work with them, and we have the right to first refusal whenever they want to take them out of the fleet”, he said.

Hertz, which reports earnings on Tuesday, declined to comment.

There is a “clear intention” to restart large-scale sales to Hertz in the future, but the two companies would “have to review at the time” whether sales restart in earnest in 2025, Ingenlath said.

Hertz’s 2022 deal was seen as a sign that EVs were on the cusp of mainstream appeal, something that gives the rental group’s latest criticism of the vehicles added weight. The group filed for bankruptcy in 2020 after a collapse in the value of its fleet and when all travel halted in the early months of the pandemic.

EV sales growth has slowed around the world, as mass market consumers display more scepticism about the technology and higher prices than had been expected.

The slowdown has seen carmakers delaying investment plans, and Renault canning a stock market listing of its EV unit, partly citing weak demand.

Polestar last year sold about 54,000 cars worldwide, although it remains heavily lossmaking.

Last week, Volvo Cars said it would sell its 48 per cent stake in Polestar to Geely, and would not inject any more funding into the brand. Polestar is seeking about $1.3bn of fresh funding."

Source: The Financial Times

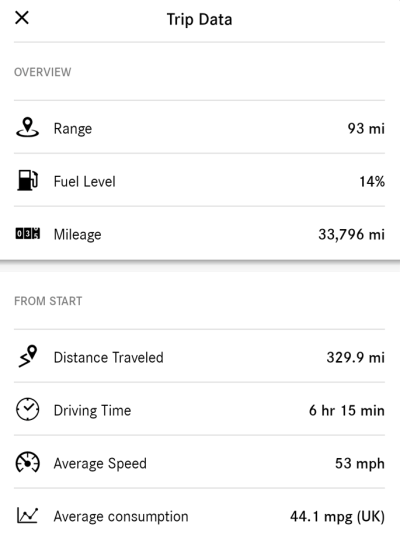

It was an ID Buzz btw - first one of these I've come across on the road. Another thing was the number of EVs with empty roof bars on them - the last thing you'd want at motorway speed I'd have thought. Also saw a Tesla Model 3 with a gigantic roof box on top - hope they take that off when not using it

It was an ID Buzz btw - first one of these I've come across on the road. Another thing was the number of EVs with empty roof bars on them - the last thing you'd want at motorway speed I'd have thought. Also saw a Tesla Model 3 with a gigantic roof box on top - hope they take that off when not using it